Canada’s immigration boosts real estate fundamentals

author

John McKinlay

Blogbeitrag

Canada’s immigration boosts real estate fundamentals

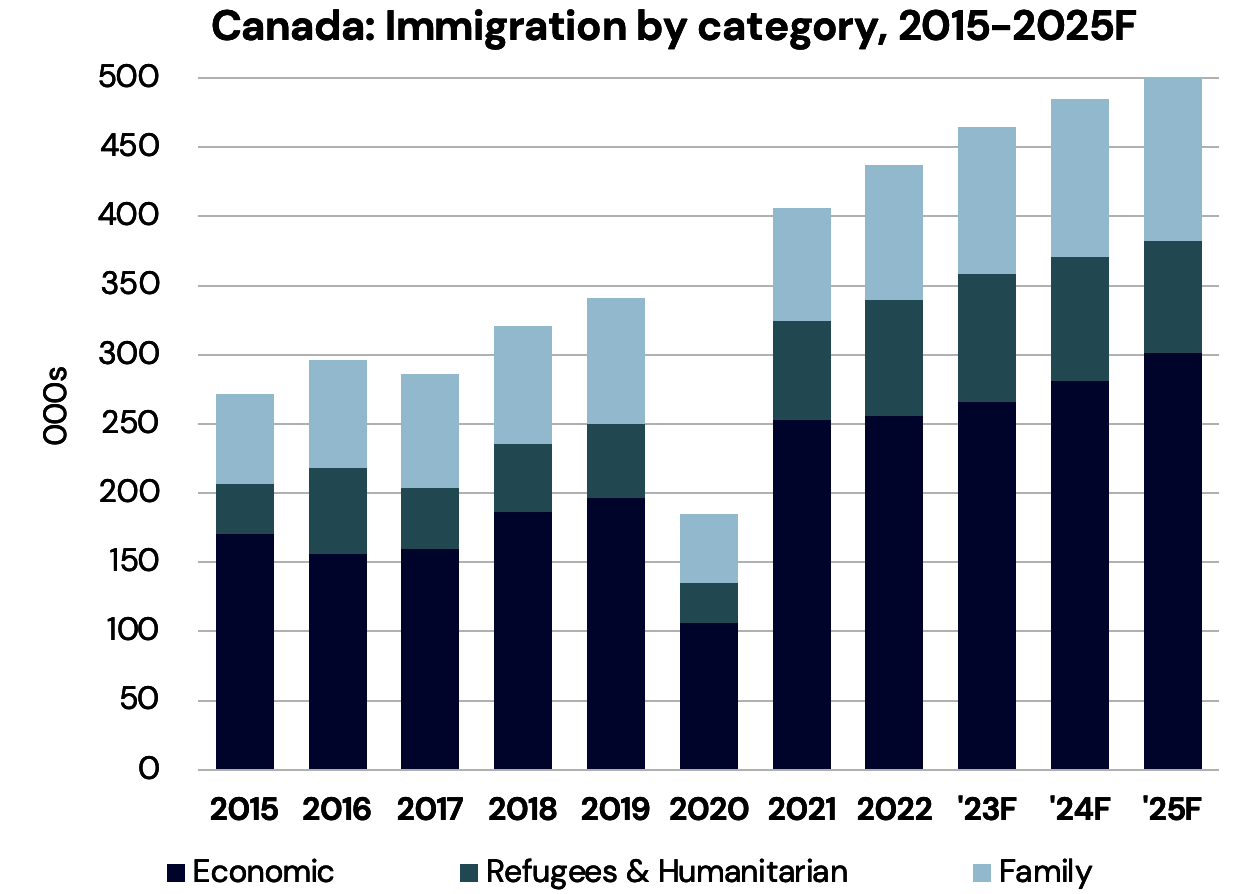

In late 2022, Canada’s federal government increased its immigration targets for the next three years, to reach a total of 500,000 by 2025. Proportionately, this is the highest total among G7 countries and a significant driver of demand for real estate. While travel restrictions during the pandemic impacted immigration levels in 2020, levels rebounded and in 2022 Canada accepted over 430,000 permanent residents and over 550,000 temporary foreign students - a new Canadian record. As a result of these high immigration levels, Canada led the G7 countries in population growth rate over the last 10 years and is forecast to continue leading in growth rate over the next decade.

Canada has long had a reputation of welcoming immigrants. Immigration contributes to Canada’s standard of living by stimulating the economy through increased consumption, production and social welfare. As retiring Baby Boomers and older Generation X workers retire and exit the labour force, immigration helps to fill these job gaps. Currently, Canada’s labour market is tight with unemployment in Canada near a record low, and job vacancies near a record high. Immigration also helps reverse Canada’s aging population by targeting skilled workers aged 25-44. According to Statistics Canada, immigrants who arrived between 2016 and 2021 are younger on average than the rest of the population and have been critical to filling open jobs.

Of the immigrants accepted in 2022, 60% were ‘economic’ immigrants who possessed higher education and highly desired skills. New immigrants tend to settle near metros like Toronto, Vancouver, and Montreal, which is why their respective provinces of Ontario, British Columbia and Quebec have the highest number of immigrants and highest demand for living accommodations in the country.

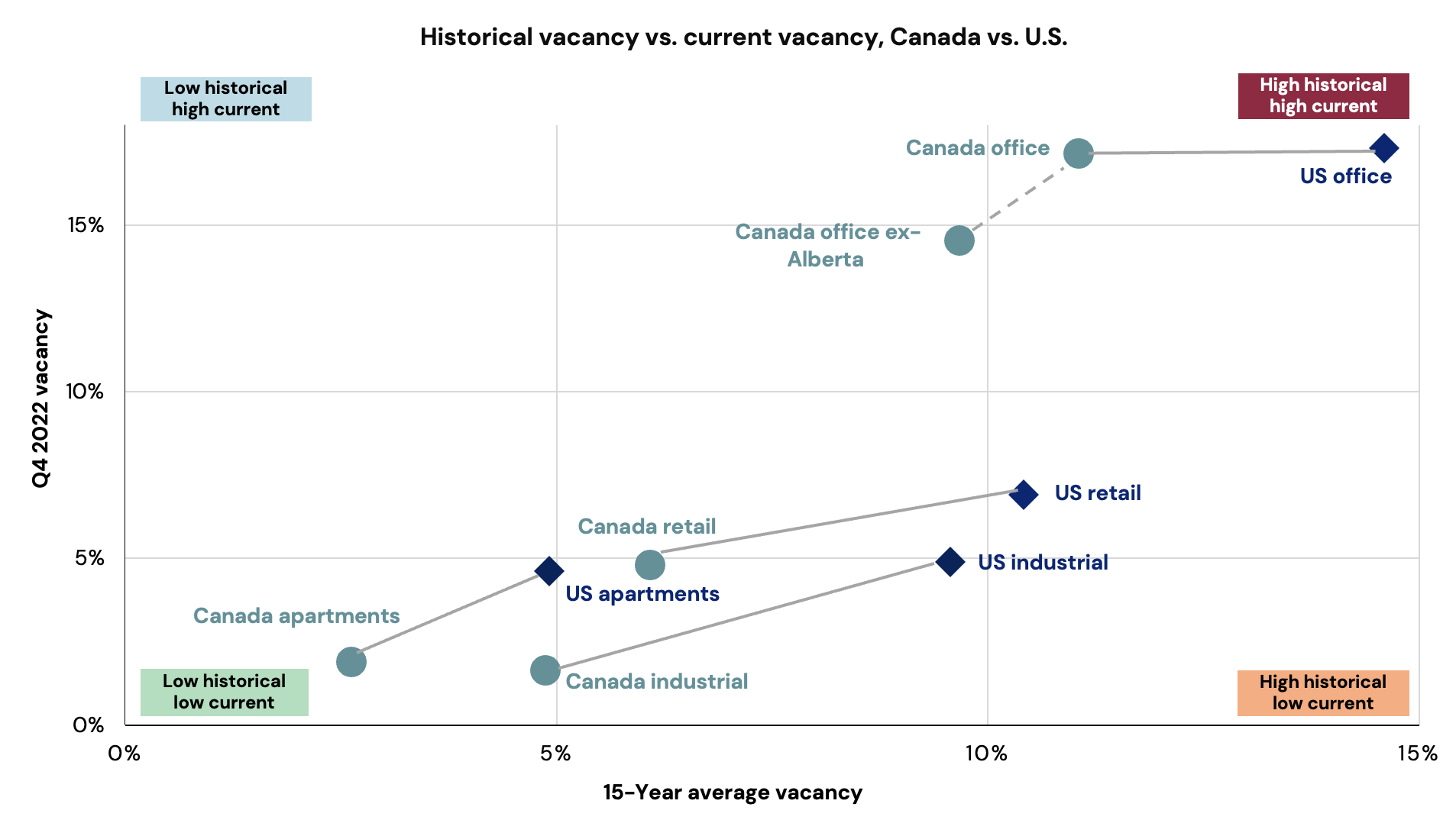

Rising immigration has boosted demand for multifamily real estate in Canada and has also benefitted industrial and retail market fundamentals. New immigrants and foreign students are more likely to rent an apartment before buying a home when they first arrive in Canada, helping to keep apartment fundamentals tight. The post-pandemic boost to immigration that Canada experienced in 2022 resulted in an all-time high absorption rate in the multifamily sector. According to Canada Mortgage and Housing Corp., the vacancy rate for purpose-built rental apartments in Canada decreased from 3.1% in 2021 to 1.9% in 2022 – the lowest level since 2001.

Canada’s accommodative immigration policies, along with promising long-term economic fundamentals make Canada well-positioned to offer attractive real estate investment opportunities. In addition, these fundamentals provide Canada with a solid foundation for continued strength in the commercial real estate sector.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.