The US industrial sector continues to show strength

Autor

Thomas M. Baur

Blogbeitrag

U.S. Industrial Sector Continues to Show Strength in the Post-Covid World

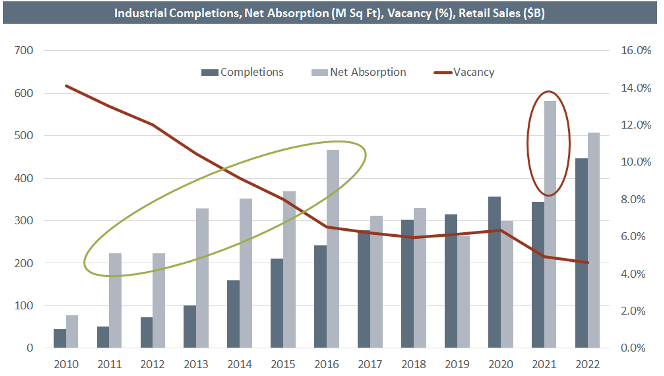

The industrial economy has been whipsawed over the last few years: manufacturers that were initially shut down in the early days of the pandemic had to ramp up quickly after consumers flush with cash from the stimulus dramatically increased online spending. The pandemic boom in consumer spending pushed demand for industrial space through the roof. Absorption surged to over 560m sq ft in 2021 - the highest ever recorded - followed by 477m sq ft in 2022 according to Cushman & Wakefield. Some of this demand was an accelerated response to a level shift in online shopping – meaning that this demand was pulled forward from future years as companies had to switch and scale their e-commerce operations sooner than expected as the entire consumer economy switched to e-commerce during the pandemic shutdowns.

As 2022 unfolded, a few important trends started to emerge that will define the industrial outlook in 2023. First, goods spending started to taper back toward pre-pandemic trend levels as stimulus and excess savings have largely been spent, and spending shifted increasingly towards services like travel and entertainment. Second, e-commerce growth reverted to its pre-pandemic trend i.e., online sales are still capturing a greater share of total retail sales relative to pre-pandemic levels, but the rate of growth has slowed. Third, higher interest rates began to weigh on demand for items sensitive to financing conditions, especially durable goods.

The outlook for U.S. industrial remains positive, despite some headwinds stemming from tighter financial conditions and less rosy job prospects. The positive outlook is supported by three structural drivers over the medium to long term:

- E-Commerce Growth – As the pandemic pushed consumers and retailers online, e-commerce share of retail sales reached record highs. As this push included many new product categories, from pharmacies to food to consumer staples, a large part of the push will likely be permanent, accelerating e-commerce adoption by perhaps as much as 10 years. Important to consider in this context is that E-Commerce operations require up to 3x the amount of space compared to a similarly sized brick & mortar operation to handle returns and since none of the inventory can be stored at store fronts.

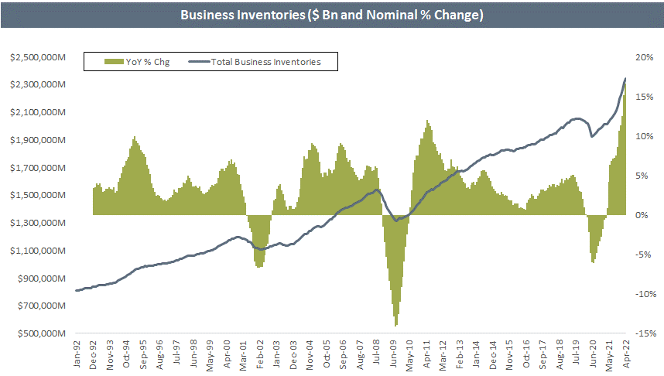

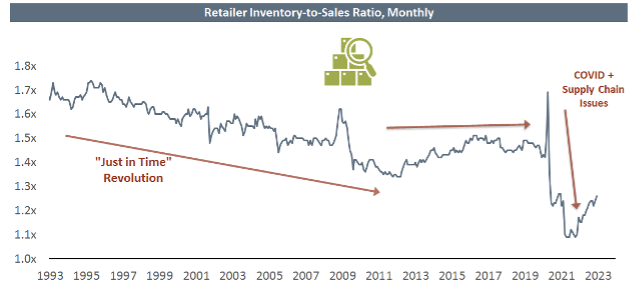

- Transition from “Just-in-Time” to “Just-in-Case” – COVID-19 has been one of the greatest supply chain disruptors in recent history. This disruption will likely push business to partially reverse the long-standing transition to “just-in-time” inventory, where inventory levels are thin relative to sales in order to gain efficiency. Having products and parts on hand “just-in-case” they are needed in a disrupted supply chain environment has become more important than gaining efficiency. Storing this larger safety stock of inventories enlarges the industrial footprint and the need for warehouse space.

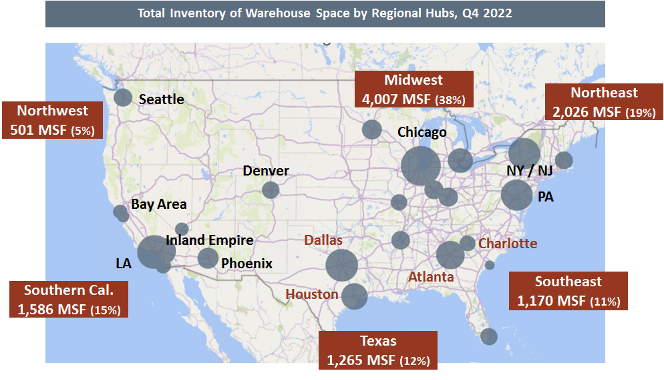

- Supply Chain Diversification – Tariffs and the COVID-19 pandemic have combined to highlight the need for a more diversified supply chain across global and domestic sources. East Coast, Gulf of Mexico, and inland trade hubs are likely to benefit from a more flexible and diversified supply chain model as retailers and manufacturers look to reduce risk of relying solely on China as their supply partner. With less industrial warehouse space available in those emerging trade hubs, locations particularly in the Southern U.S. such as Charlotte, Charleston, Atlanta, Dallas or Houston are likely to outperform in the near term, even if there is a national slowdown.

A strategy focused on industrial real estate catering to this final step in the value chain -delivery to end-consumers- presents the most attractive opportunity. The strategy is focused on acquiring and developing mid-sized distribution spaces in underserved markets with high growth populations and consumer bases. The end-consumer market has been facing a supply-demand imbalance, and we expect that to continue since bringing newly developed space into increasingly tight infill locations has proven to be challenging. When rising demand meets constrained supply, the rewards for new, ground-up development opportunities become more compelling for those who can find them.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.