Structuring debt in today’s environment

Autor

Dave White

Blogbeitrag

European real estate credit – structuring debt in today’s environment

Real estate credit today is a compelling investment opportunity, with the cash pay profile, sizeable liquidity gap, and ability to invest at an attractive entry point all attracting capital to the asset class. It is important however to account for a number of variables when thinking about investing in the space.

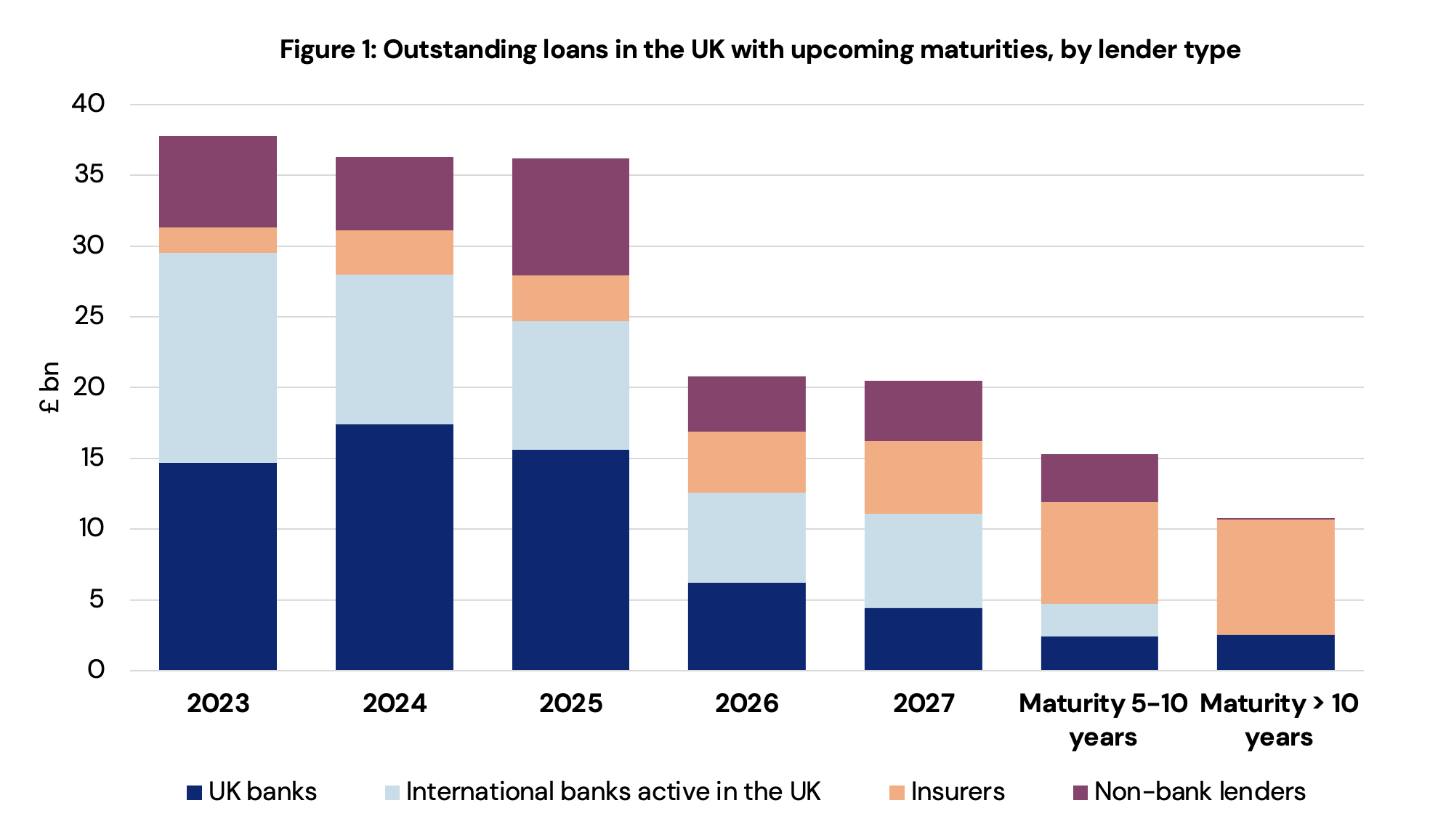

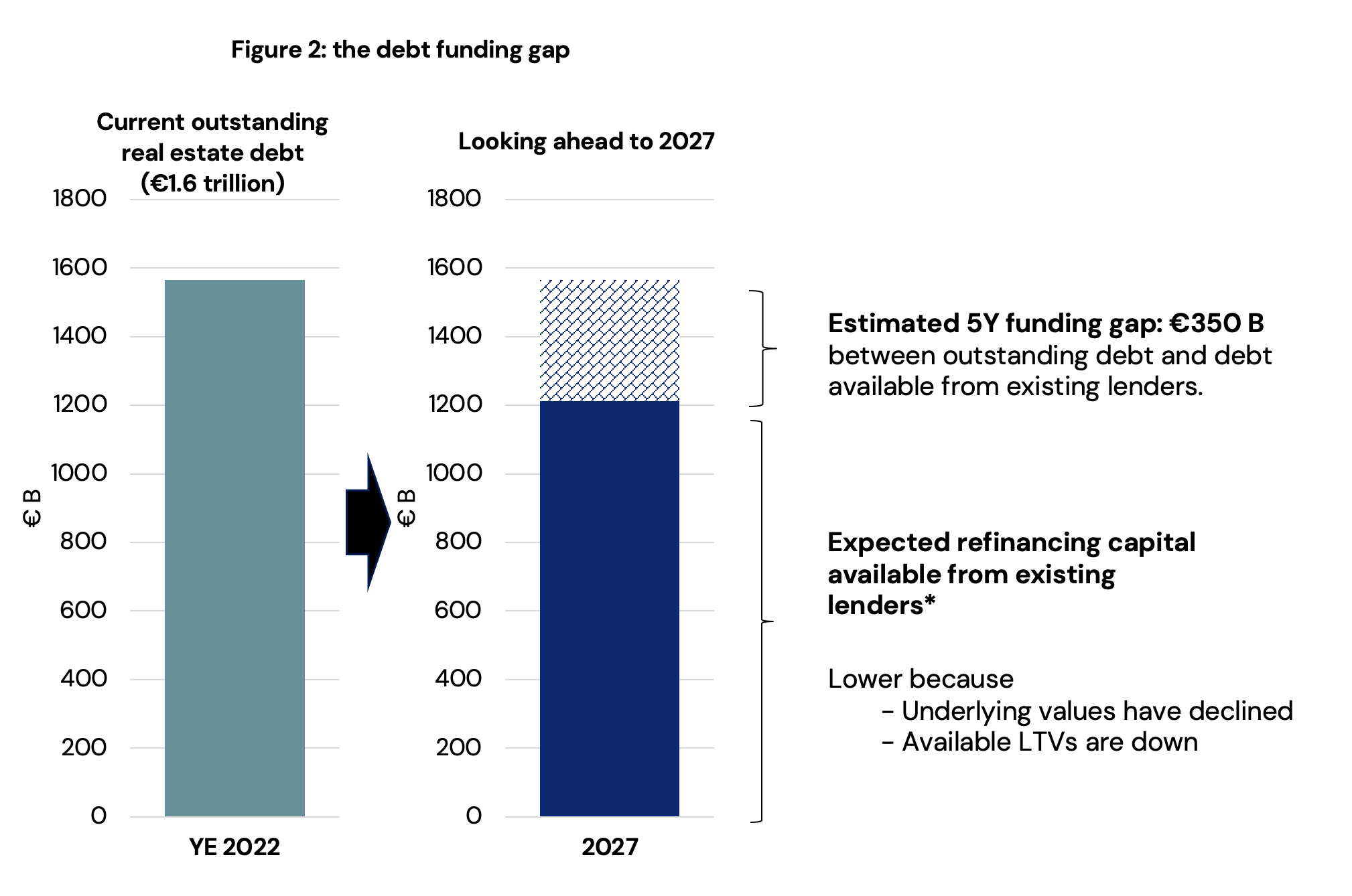

The financing gap is today estimated to be €350 billion. As interest rates rise globally and lenders scale back risk-taking in the face of macroeconomic uncertainty, leveraged owners of European real estate face a challenge as loans fall due for repayment or renewal. In the UK, where transparency in real estate credit markets is most established, £110bn of real-estate-backed loans will fall due over the next three years. Bayes Business School estimate demand for real estate finance in Europe at €310bn per year, and the current stock of outstanding real estate debt at €1.6 trillion.

However, as underlying values have declined and available market loan-to-value ratios (LTVs) are down, traditional lenders may only be willing to advance around €1.25tn of the capital necessary to refinance loans maturing through 2027. The €350bn remainder forms the European ‘debt funding gap’.

There is opportunity here for alternative lenders, who are well-placed to help sponsors make up the shortfall given a sound business plan and carefully underwritten collateral. As well as being able to offer higher LTVs than more traditional lenders, alternative lenders may enjoy more favourable capital treatment than that required of banks under the Basel framework.

In light of this, structuring becomes important for the ability of lenders to deploy capital effectively. When underwriting risk that traditional lenders are less willing to take on, mitigating that risk and protecting investor capital is a key focus. While equity holders will typically focus on positive controls that drive value, lenders will focus more on protecting against downside risk, through structures that include protections like cash traps, LTV triggers, and interest coverage ratio (ICR) covenants. These will typically be set such that equity owners derive full benefit from a successfully executed business plan, but lenders are protected with early warning triggers in the event of adverse events that could include cost overruns, delays to lease-up, or increases in vacancy. It is therefore important to strike the right balance of supporting a borrower from the start, and having the right measures in place to protect capital in a downside scenario.

Though many refinancing needs will be met by a traditional senior-mezzanine lending structure governed by an intercreditor agreement, an increasingly prevalent structure sees a whole loan provided by an alternative lender. This can be a valuable tool for lenders in a number of scenarios. It provides a single counterparty for the borrower to work with allowing for more certainty of execution, as well as enhanced control for the lender who can negotiate a deal on behalf of a larger portion of the capital structure. The whole loan provider also has control of when loan on loan leverage can be implemented which can benefit a lender from both a risk and return perspective.

The flexibility afforded by the variety of available debt structures should help to ease the transition to an environment of higher interest rates, allocate risk to where it is most suitably borne, and ensure that good-quality properties continue to see liquidity in the market.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.