The Long-Term Funding Gap in European Real Estate

Autor

Andrew Radkiewicz

Blogbeitrag

The Long-Term Funding Gap in European Real Estate

In Europe, there are a combination of market drivers that are collectively impacting the real estate market:

- European regulations are putting significant sustainability obligations on real estate developers, investors, and occupiers.

- Simultaneously, bank regulations are severely restricting banks’ ability to provide development or refurbishment finance.

- Additionally, bank credit factors are being heavily influenced by the interest rate outlook, resulting in tighter debt service cover, lower loan-to-values, refinancing stress and limited advance rates. In aggregate, these drivers are creating a widening gap between the growing demand for future-proofed properties, and the permanent reduction in bank debt to fund the supply of such real estate. This funding gap presents an opportunity for experienced alternative debt providers to finance the next generation of European property.

Net Carbon-Neutral Policy

Across Europe is Accelerating the Demand for Sustainable Buildings Europe’s net-zero commitments are driving demand for prime property that is aligned with 2030 and 2050 decarbonization trajectories. With real estate accounting for 39% of total emissions of CO2 and 36% of energy use1, real estate will be hugely impacted by these goals, particularly through occupier and investor demand.

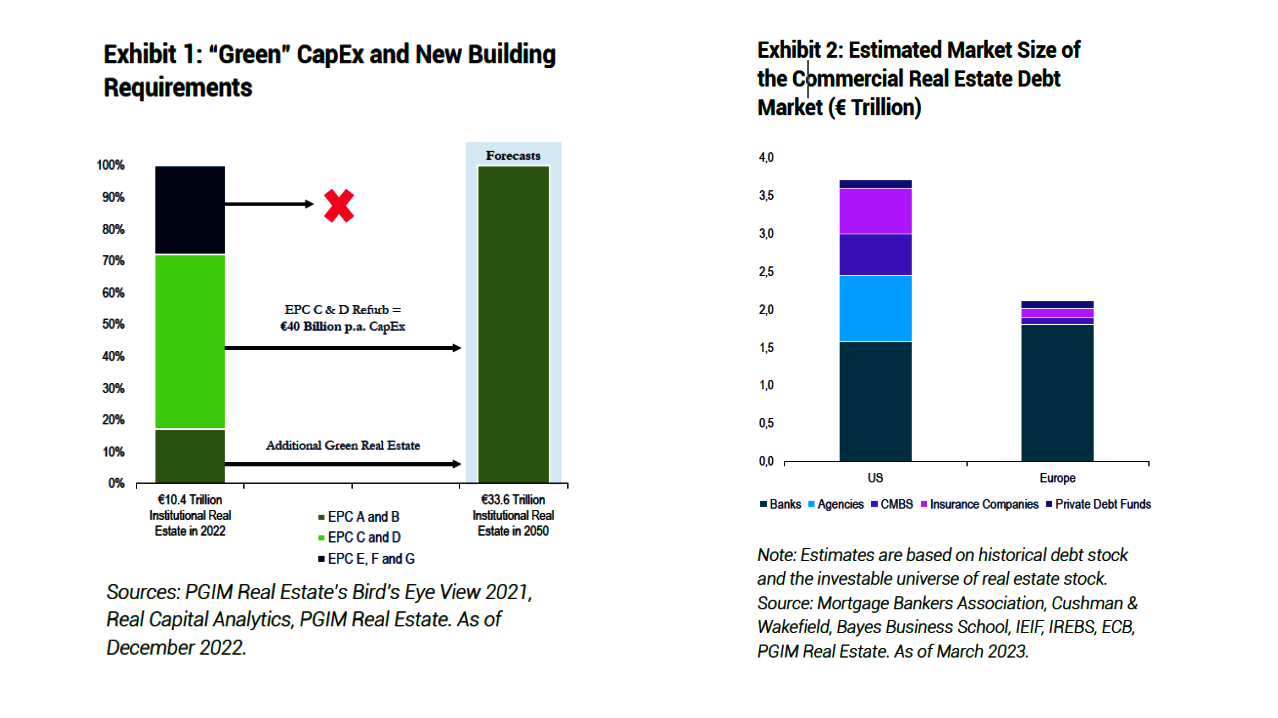

From a European supply perspective, only about 17% of existing institutional real estate is rated EPC A and B, the minimum threshold needed to satisfy future sustainability requirements. An estimated € 40B per annum is required to upgrade lower-rated buildings, in addition to the new developments required to meet expected 2050 demand for compliant properties.

We expect financing opportunities to emerge across the capital stack. ESG considerations make refurbishment increasingly relevant, alongside redevelopment and new construction, due to the impact of embodied carbon within 1 Source: INREV existing structures. However, much of the older, poor-quality stock (rated EPC E and below) will be obsolete.

Alternative Lenders Can Play an Increasing Role in Financing the Green Built Environment

Regulatory constraints on banks mean that financing solutions will increasingly have to come from other market participants. Banks, who dominate European lending markets, hold over 85% of all real estate loans in Europe, compared with much more diversified sources of capital in the United States (Exhibit 2, LHS). However, those banks are more constrained than ever in their capacity to lend.

The funding gap that emerged in Europe after the financial crisis has been further exacerbated by regulatory and credit factors.

- Bank Regulation: Basel III Finalization is the latest in a cascade of regulatory changes that have consistently increased bank capital requirements against real estate loans, estimated to remove over €125B of lending capacity from the banking system

- Credit Factors: Higher interest rates have resulted in tighter debt service coverage ratios. This has been the key driver of lower LTV loans and thus lower advance rates. Given longterm interest rates are forecast to be elevated in Europe, there will be less money in the system for acquisition and refinancing.

Alternative lenders entered European real estate credit markets after the GFC, and now form a key part of the funding market. However, significant growth is clearly needed in private debt to satisfy demand over the next decade and thereafter.

Conclusion

A significant investment is needed to tackle carbon emissions and the policies in place to combat it, real estate has an important role to play in achieving operational net-zero targets. A green built environment of the future will need new capital for development and refurbishment projects. These factors are all driving the underlying demand for European real estate debt and make the case for investing in solutions that are poised to meet the needs of the future of European commercial real estate.

Copyright Headerbild: AdobeStock_619349828

This article was published as part of the DEBT SPECIAL 2023.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.