Can real estate beat the high inflation environment?

Autor

Indraneel Karlekar, Ph.D.

Blogbeitrag

Can real estate beat the high inflation environment?

Inflation in the U.S. has risen to levels last seen in the early 1980s, raising fears of being entrenched in the post-pandemic economy. Many factors resulting directly from pandemic-related disruptions and the conflict in Ukraine have led inflation to spike, including loose monetary policy, massive fiscal support, supply chain bottlenecks, and elevated commodity prices.

As a consequence, the Federal Reserve’s inflation outlook changed from transitionary to longer term, forcing the central bank to embark on the most aggressive cycle of monetary tightening since 1981. Consensus now estimates inflation to moderate to 5.5% by the end of 2022 and 2.9% by 2023, which should relieve some strain, even though with moderately higher interest rates and slower economic growth. With these premises, can U.S. commercial real estate beat the current high inflation environment? The answer is yes, but with a caveat.

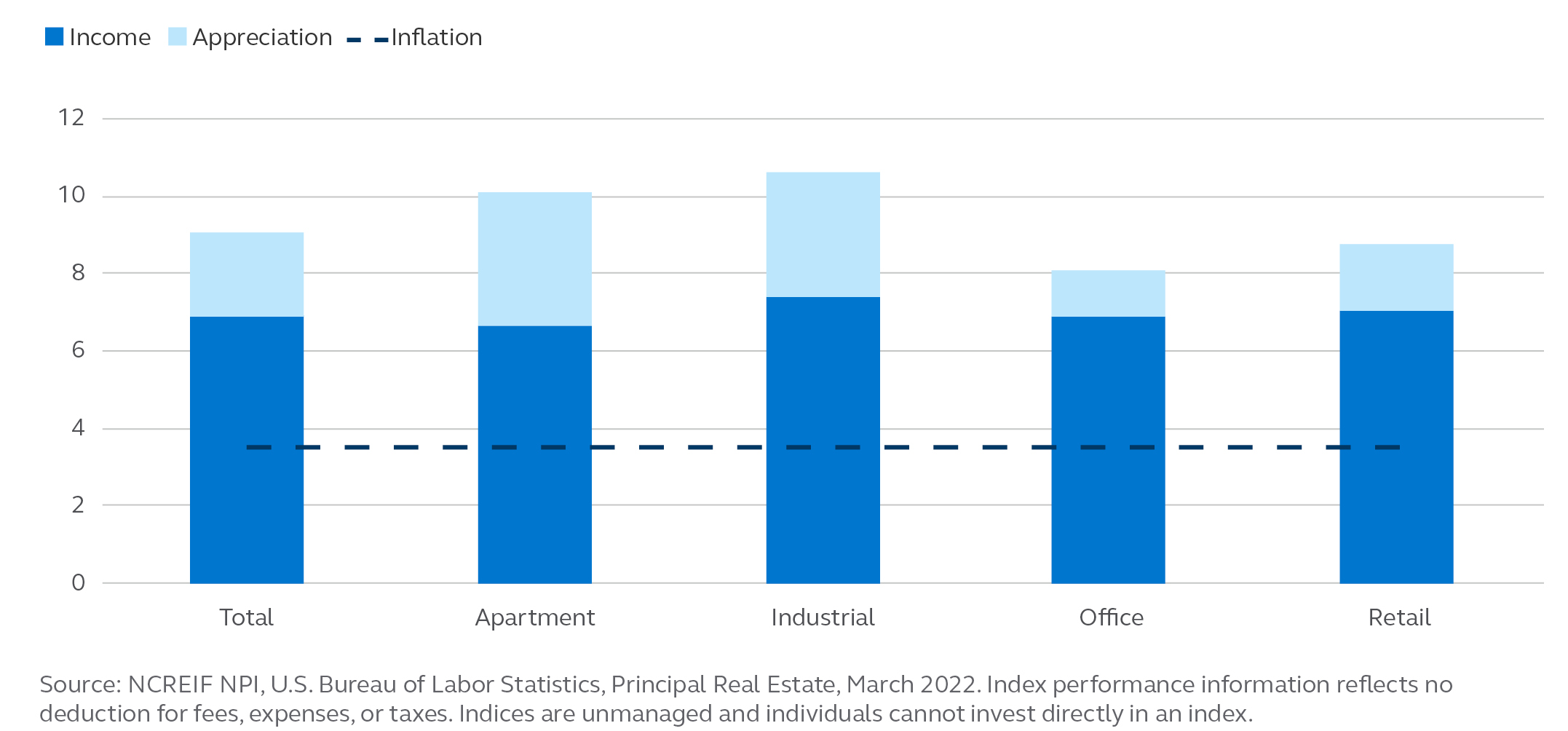

The case for U.S. commercial real estate as an inflation resilient asset class is certainly clear based on analysis of historical data. Since 1978―the first year for which NPI data are available―private equity real estate has offered a total return of 9.2% on an annual basis with a 7% income return. Such steady and healthy income returns are partially the result of a landlord’s ability to frequently reset rents on short-term leases, like apartments, and underwrite periods of unanticipated inflation by including escalator clauses in longer-term leases, like the industrial sector. Add appreciation of 2.2% and commercial real estate since inception has outperformed inflation (which has averaged 3.5% over the same period) by a total of 570 basis points on an average annual basis.

Exhibit 1: NCREIF Property Index since inception returns have outpaced inflation

NCREIF property type returns relative to inflation annualized since inception (Q1 1978)

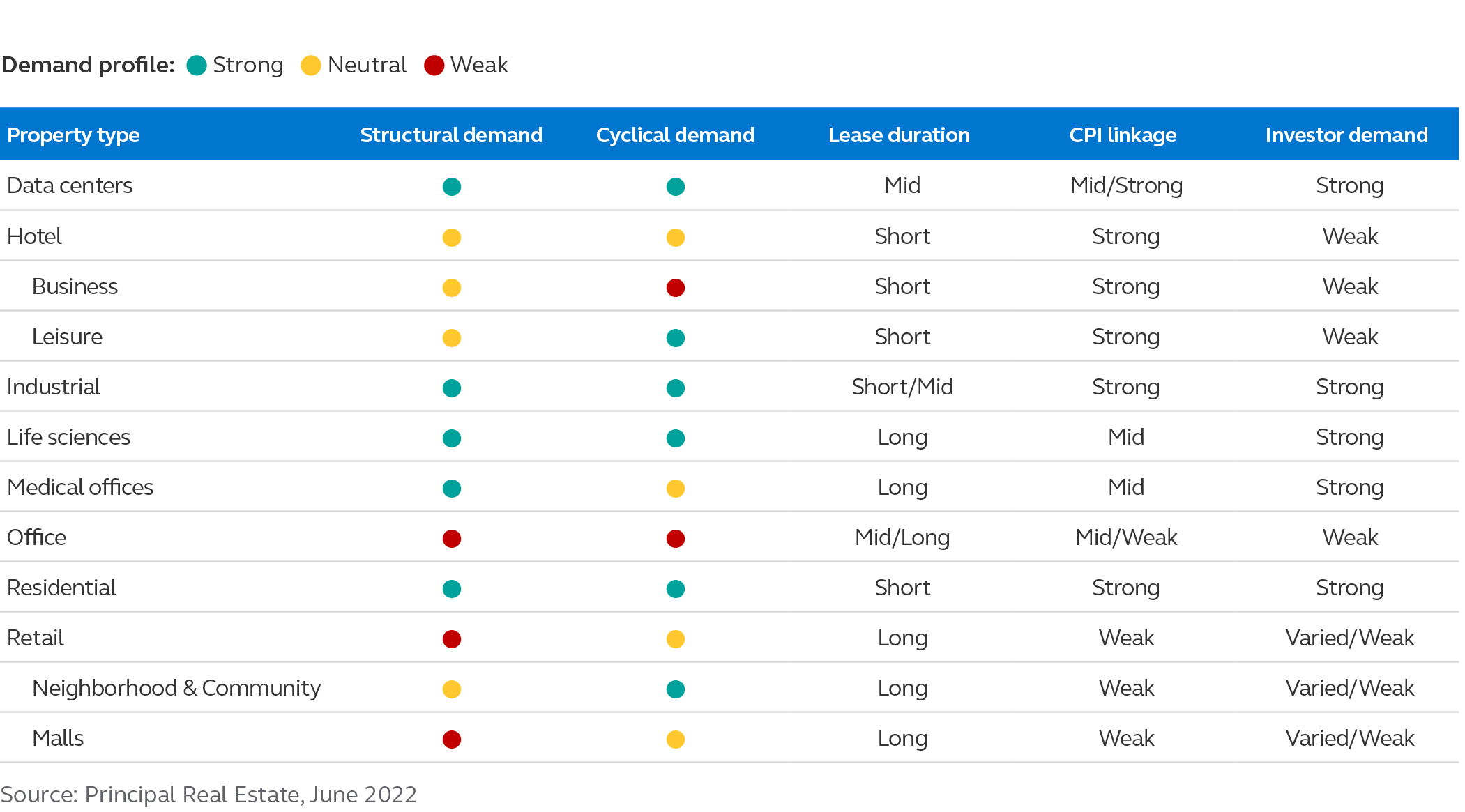

That said, it does not mean that U.S. commercial real estate is inflation-proof and different cycles bring with them unique sets of circumstances. When we look at property sector performance over the past 40 years, strong underlying demand drivers, market fundamentals, and asset selection are far more important than interest rates and inflation. Investors need to carefully evaluate the potential for sustained demand on both a cyclical and structural basis when considering portfolio construction. For example, both apartment and industrial assets have performed particularly well recently, despite a high inflation environment, while headwinds for office and retail remain challenging to landlords and, in turn, investors.

In conclusion, U.S. commercial real estate can potentially provide investors different options to mitigate against the elevated levels of inflation that are likely to persist over the short-term. While not all property sectors, or locations, will offer the same performance or the same hedge against inflation, resiliency in demand and the structure of leases can go a long way in creating the type of portfolio that may provide shelter against high inflation. It is recommended focusing on a mix of emerging growth and traditional property types in metro areas aligned with long-term structural drivers that include technology and strong demographic growth profiles. Exhibit 2 contains a snapshot of the sectors investors could consider in building a portfolio.

Exhibit 2: Inflation and real estate: Some considerations for investors

This article is for discussion and educational purposes only and should not be relied upon as a forecast, research or investment advice, a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are subject to change without notice. References to specific securities, asset classes and financial markets are for illustrative purposes only and should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances before making an investment decision. Potential investors should be aware of the risks inherent to owning and investing in real estate, including: value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk.

US real estate

USA Conference

All speakers at the conference are experts for investing in US real estate. They share their insights and forecasts through a series of focused presentations, culminating in a closing panel which discusses opportunities and strategies for investing in the US this year and beyond.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.