Non-traditional property types in the mainstream

Autor

Indraneel Karlekar

Blogbeitrag

Non-traditional property types are moving mainstream

Historically, institutional real estate investors have allocated capital to five property types in the U.S.—office, retail, multifamily, industrial, and hotel. But, in recent years, a number of niche and emerging property types have seen a significant increase in investor interest and capital allocated, in both public and private real estate quadrants.

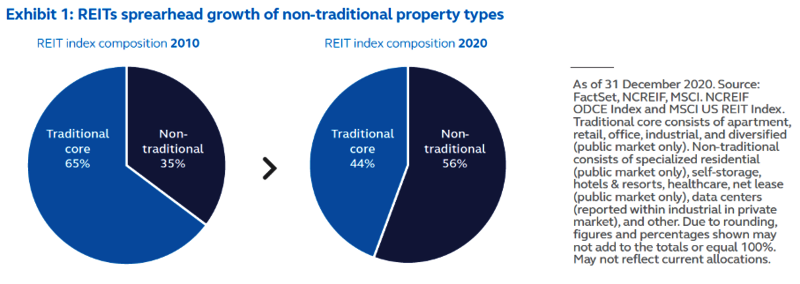

The listed REIT market has spearheaded the push into non-traditional property types (ex. 1), greatly expanding the investment universe and improving the diversification outcome for investors. Many of the largest REIT companies by market capitalization belong to the non- traditional property type category.

Private real estate investors are rapidly embracing non-traditional properties

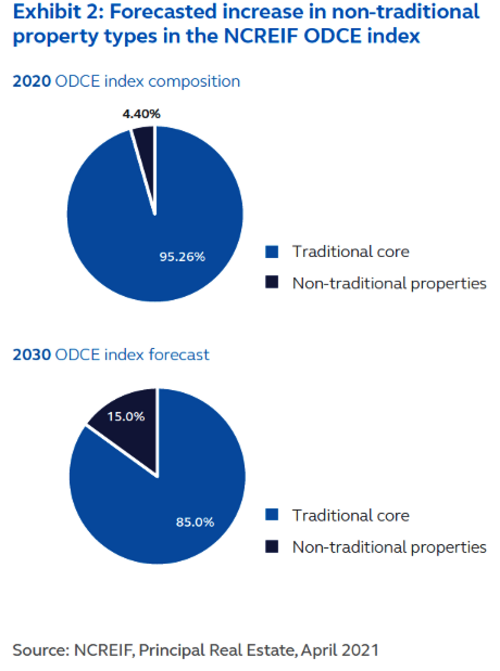

The past couple of years has seen a significant uptick in investment into non-traditional property types by private real estate investors. Currently these properties sit at 5%-6% within the National Council of Real Estate Investment Fiduciaries (NCREIF) ODCE index. Our expectation is that, on a conservative basis, non-traditional property types could comprise 15% of the ODCE index by 2030, a near tripling from current levels.

The growth of non-traditional properties represents a secular shift in demand drivers

The rapid and significant adoption of non-traditional property types is not just a cyclical rotation: in our view, it reflects a structural shift within the economy where “DIGITAL” drivers of growth and demand—Demographics, Infrastructure, Globalization, Innovation and Technology—have become more dominant in recent years. The pandemic accelerated these structural changes, in some cases rapidly upturning how consumers and businesses behave and occupy space.

Listed REITs show non-traditional properties can benefit portfolios

Critically investors need to understand the benefits to portfolio diversification that non-traditional property types may bring to an existing real estate allocation. The early and rapid adoption of non-traditional property types in listed REITs provides a robust data set of performance metrics and indicates non-traditional property types have delivered some of the strongest absolute returns over a 20-year history. Self-storage, health care and manufactured homes property types stand out for their strong absolute performance over nearly all time periods.

Correlation analysis further demonstrates the diversification benefit of adding non-traditional property types to a portfolio. Despite the growth and maturation of non-traditional property types, correlations have stayed low indicating the variability of business and operating models that are brought into a portfolio with purely traditional property types. In fact, it is the operating model of many of these underlying companies that helps bring in added diversification to a more traditional portfolio comprised of income-oriented real estate.

Investors will be winners as non-traditional properties go mainstream

In our view, the mainstreaming of non-traditional property types is well on its way within institutional investing with several positive implications. Non-traditional property types will materially broaden the real estate investment universe and in turn attract a wider array of investors. The shift and expansion of the universe should also allow investors to generate additional alpha by making conscious investment decisions on their strategies pertaining to alternative property types. Ultimately, we believe the growth and assimilation of non-traditional property types will be a material benefit to the asset class, attracting additional capital and enhancing investment opportunities.