Managing Risk with commercial real estate loans

Autor

Darren Rawcliffe

Blogbeitrag

Managing risk amid uncertainty with commercial real estate debt

The healthy appetite for commercial real estate (CRE) debt from investors around the world continues. Not a single investor wanted to reduce their exposure to debt, according to the 2020 INREV/ANREV/PREA survey covering CRE debt vehicles. It also reported that more investors were diversifying by using a combination of debt funds in North America, Europe and APAC.

This is unsurprising, given the considerable uncertainty over the economic outlook, investors are actively seeking ways to manage and diversify risk. And the reliable cash flows and downside risk protection offered by private commercial real estate debt make it a compelling option.

Appealing across the cycle

Our analysis shows that private CRE debt funds delivered solid and reliable returns over the cycle with much lower volatility than equity funds. This means private CRE debt funds provided better risk-adjusted returns, even though their nominal returns were often lower.

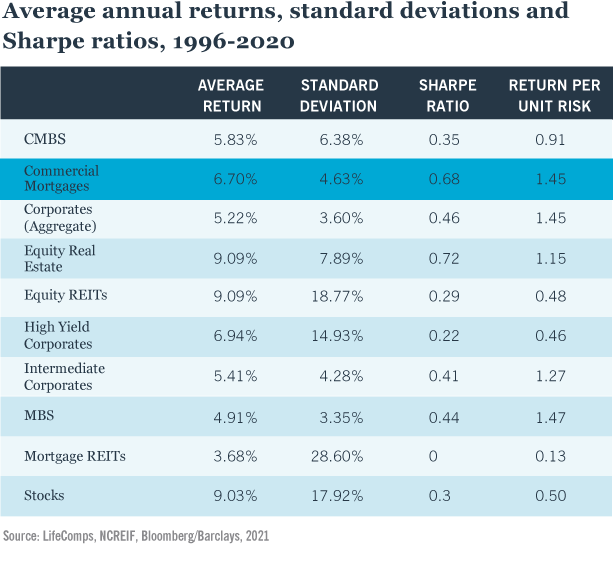

Performance is not always easy to track given data limitations in many of the most popular countries for CRE debt. But available data in the U.S. does showed a history of debt products performing strongly (see figure below), producing high risk-adjusted returns when compared with other asset classes. In addition, core mortgage loan returns are a source of portfolio diversification, due to their low correlation with those of stocks, equity real estate and REIT returns.

Downside risk features

Underpinning this performance is the debt’s loan-to-value (LTV) ratio that creates an equity cushion to reduce downside risk. This downside protection helps explain why debt funds can deliver expected returns even if capital values are falling. Lenders can insulate themselves from a weak market if their portfolio has been protected sufficiently with income and LTV covenants that protect the lender in the event of default. These buffers reduce their value at risk.

The low volatility of capital values and solid income flows mean that the focus of debt investments is resilience rather than growth. However, capital volatility differs between CRE sectors over the course of the cycle, and between countries, which creates differences in lending risk.

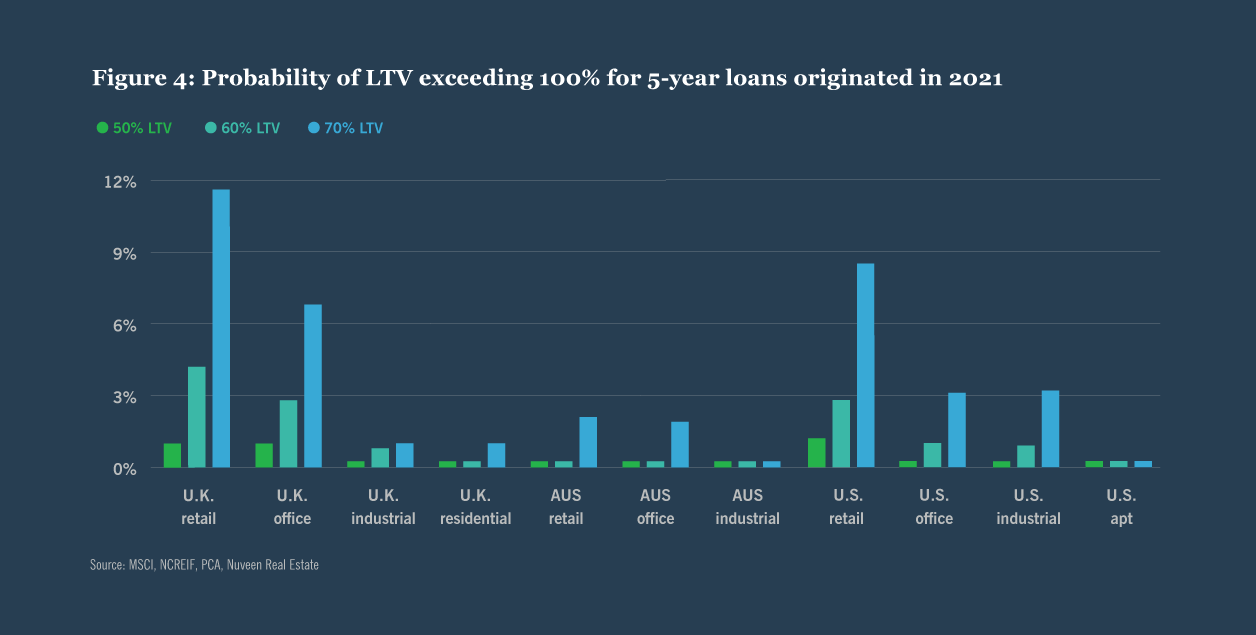

Keeping LTV covenants significantly below 100 per cent dampens these differences, but does not eliminate them. We investigated the impact of LTV covenants on loan resilience by using Monte Carlo simulations to model the risk of a loan’s LTV ratio exceeding 100 per cent in the final year of the loan. This is different from default risk, but we expect an increase in this probability to be associated with higher default risk.

Based solely on historic returns, our simulations showed that for a 50 per cent LTV 5- year loan, the risk of LTVs exceeding 100 per cent at the end of the loan was less than 1 per cent in all of the country sectors we studied (see figure below). Increasing the LTV to 60 per cent produced the same conclusion, even though capital volatility was significantly different across our sample. This suggests that an equity cushion of 40 per cent to 50 per cent of asset value has tended to dampen the impact of capital volatility at the market level on lending risk in the country sectors we studied.

When we increased the LTV ratio to 70 per cent, and reduced the equity cushion to 30 per cent, we began to see some evidence of differential risk between markets, but at very modest levels. The risk of LTV ratios moving above 100 per cent was around 2 per cent in office, industrial and retail portfolios in the U.S. and U.K., but remained below 1 per cent in U.S. residential, U.K. residential and in all the Australian sectors.

These results suggest that over the last 25 years on average, the additional risks for debt funds of increasing LTV ratios and reducing the equity cushion were relatively small and could have been compensated by small increases in lending margins. (We also ran a second set of simulations which included five-year return forecasts rather than rely solely on historic returns, details of which are in the report.)

Risk mitigation

Our research suggests that lenders need to identify where loans are at greater risk due to market volatility and ensure margins are high enough to compensate for that risk. They should also manage risk through sponsor selection, real estate asset analysis and mortgage design.

Investors who are keen to explore the risk-adjusted returns and diversification properties of CRE debt should partner with experienced and expert CRE lenders. These partners will have developed the sponsor relationships and the contract features that have been reliably shown to reduce risk. Lenders who are active in the real estate market themselves can leverage their own knowledge and experience, as well access to proprietary and market data, to better analyse and underwrite risk. Such vigilance and risk management are necessary in when the economic outlook remains so uncertain.

Co-Autor

Jayanth Ganesan