Views of the US Residential Market

Autor

Christopher Muoio

Blogbeitrag

Views of the US Residential Market by a US Direct Secondary Manager

US Residential property prices and rents have surged over the last two years, with home prices climbing 36%1 since the onset of the pandemic and multifamily effective rents up 19% from their pandemic lows in the fourth quarter of 2020.2 While much has been written about increased migration fueling gains in home prices and rents, it seems the true driver of the substantial appreciation has been historically low levels of supply as long-term demographic based measures of housing demand have remained stable from pre-Covid levels.3 Through this lens, the rise in occupancy and rents is fundamentally similar to the supply chain disruptions and inflationary pressures that have been observed in the goods sectors of the economy. It is believed the dynamics affecting residential supply are poised to normalize in the coming quarters.

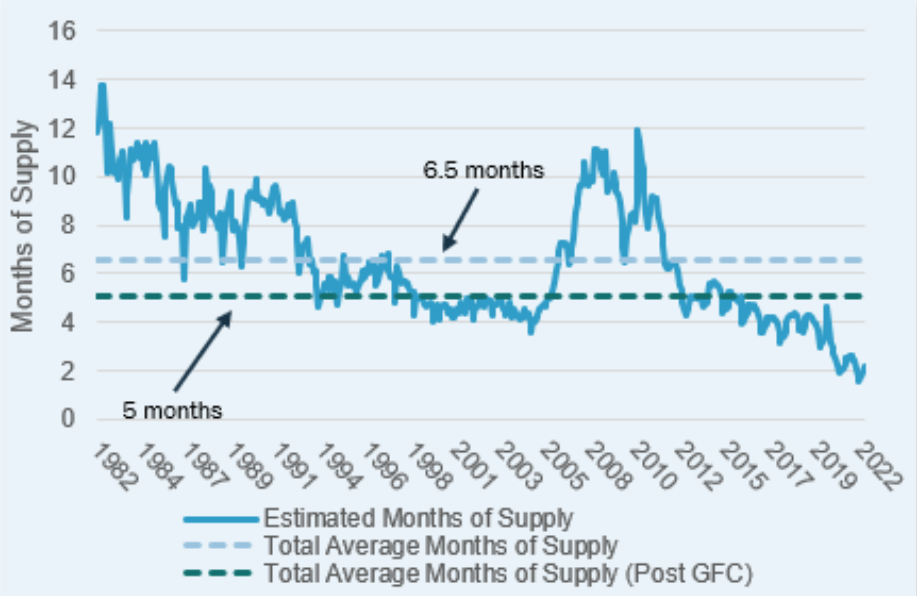

Supply conditions for both for-sale and rental housing have been tight since before the onset of the pandemic due in our view to the secular tailwinds for housing demand that had been unmet, but conditions deteriorated in the years that followed. Single-family home available supply (measured in months of sales) fell to a historic low of 1.6 earlier this year, less than half the normalized level of just over 4 months.4 On the rental side, existing vacancy is low as well, with REIS reporting vacancies of just 4.5%, down 90 bps from their pandemic high, and Single- Family Rental (SFR) vacancy at just ~2%.5

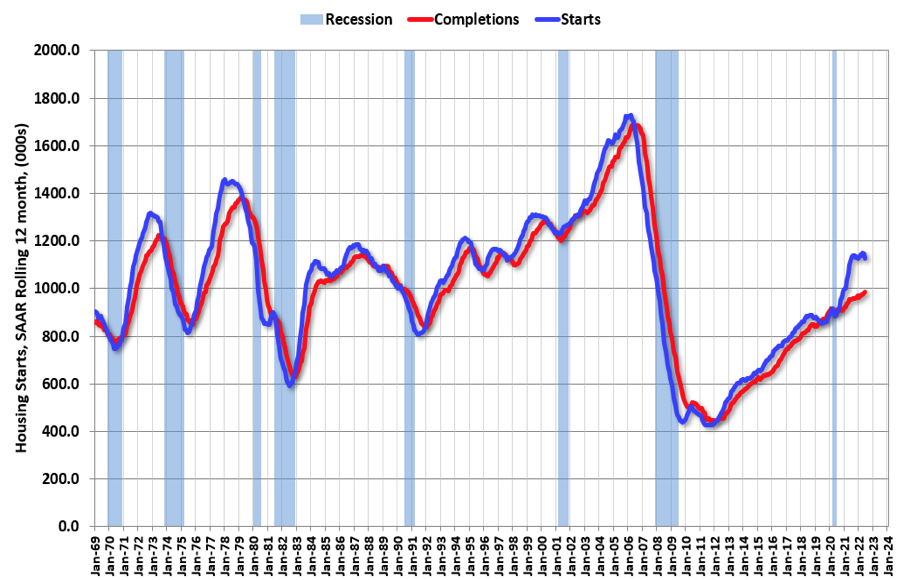

The tightness of the residential market has been further exacerbated by supply chain disruptions. While single-family housing starts have risen steadily over the last few years, completions are lagging starts by the widest gap in the data’s history6 as builders are unable to finish projects owing to materials shortages and other disruptions. Multifamily is facing a similar phenomenon. The US saw just 9,014 multifamily units delivered in the second quarter per REIS, the lowest total since the aftermath of the Great Financial Crisis (GFC). Over the last four quarters the US has averaged just 30,000 units delivered per quarter, half the rate seen prior to the pandemic.7 Meanwhile, permit issuance for new construction is at its highest level since 19868). The SFR sector, which has garnered a lot of headlines due to its increasing institutionalization, is being further squeezed beyond the lack of new supply as it is also seeing existing supply contract. Total SFR supply has fallen for seven consecutive years and now only represents 10.3% of existing housing stock.9

However, it is believed that the supply dynamics are about to shift. In their latest (June 2022) survey, John Burns Real Estate Consulting noted that 38% of builders reported that supply bottlenecks were getting better, the highest level in over a year. Currently, 92% of builders believe supply conditions are stable or improving, potentially indicating an improvement in completion rates.10 Five months of new home supply is under construction but not yet or unable to be completed, on par with the highest levels seen during the GFC and REIS is projecting 356,000 multifamily units will be delivered over the next six quarters, nearly tripling the pace of supply observed over the past four quarters.11 There is an opinion that the impending normalization of supply and vacancy will temper rent growth and could result in the potential underperformance of assets which were bought at “priced to perfection” pricing. The slowed rent growth coupled with an increase in interest rates could also dampen lender appetite in terms of loan proceeds, making liquidity via refinancing a more challenging prospect. Together, we expected these trends to generate opportunities in the direct secondaries space as sponsors may seek to hold assets longer and investors who need liquidity may seek alternative paths to that liquidity at discounted pricing.

1 Federal Reserve Economic Database (“FRED”), July 2022

2 REIS, July 2022

3 Refers to Population Growth (US Census, Data 2021 Pulled July 2022), Household Formations (FRED June 2022), Utility Customer Accounts (JBREC July 2022)

4 JBREC June 2022

5 GreenStreet, July 2022

6 FRED June 2022

7 REIS, July 2022

8 FRED June 2022

9 JBREC July 2022

10 JBREC, July 2022

11 REIS, July 2022

US real estate

USA Conference

All speakers at the conference are experts for investing in US real estate. They share their insights and forecasts through a series of focused presentations, culminating in a closing panel which discusses opportunities and strategies for investing in the US this year and beyond.

weitere Informationen

Werden Sie FondsNews-Leser!

Fachartikel, Informationen und Nachrichten der institutionellen Immobilienwirtschaft.