US Market Update

Autor

Joseph Munoz

Blogbeitrag

The global pandemic hit the US hard, but despite challenges in 2020 the economy is well positioned for a strong recovery in 2021. The two key drivers of the US recovery are a robust pace of vaccinations in late 1Q and the start of 2Q along with significant fiscal stimulus.

The consensus view is the US economy will experience robust GDP recovery and job growth in 2021. The recovery’s pace is strongest in the service sectors hardest hit economically by COVID. In 2020 there were sharp declines in spending at restaurants, in-person entertainment and travel. As people get vaccinated and feel comfortable getting back into the world those sectors are starting what is expected to be a strong rebound.

This recovery has contributed to interest rates rising from historic lows in 2020, though rates remain low relative to pre-COVID levels and are accommodative for economic growth and real estate investment. The recovery has also led to price increases in some parts of the economy, spurring a focus on short and long-term inflationary risks.

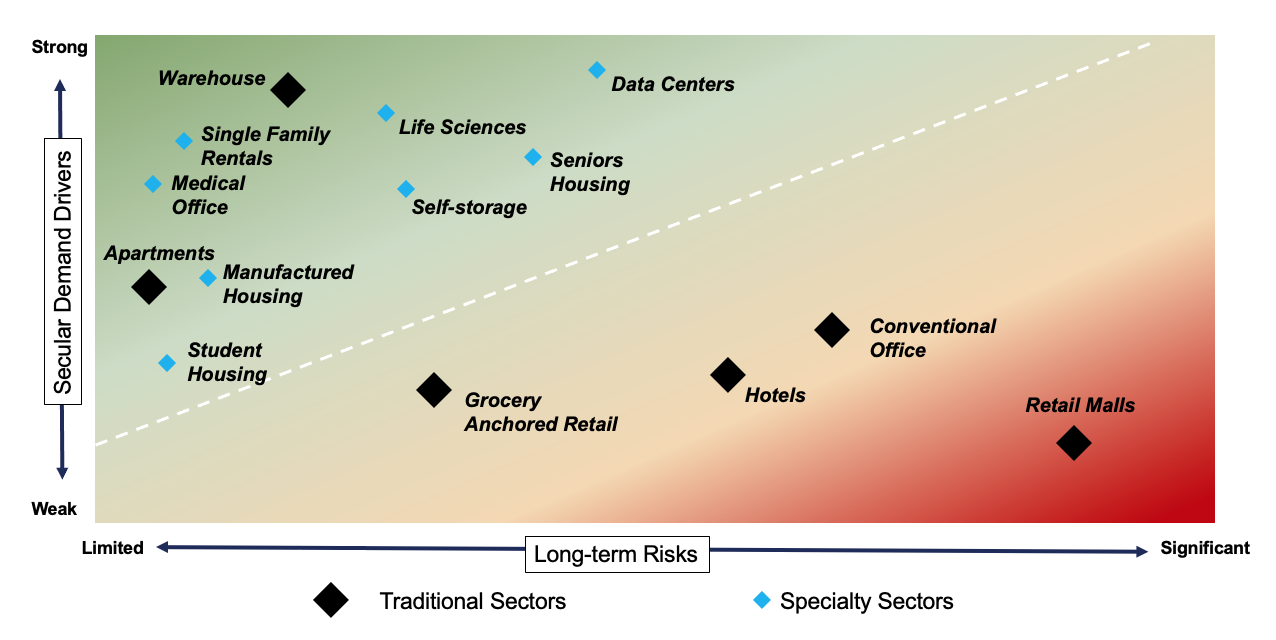

Beyond inflation, key decisions facing US real estate investors are about property type and market selection. The US is currently seeing a dramatic divide in real estate performance by property type. The leading property types of logistics, apartments, medical office, life sciences and various residential specialties are seeing strong fundamentals and investor demand. However, retail and traditional office have a weaker fundamentals outlook and less investor interest. Investors need to answer if they want to chase the herd into the strong property types or make a contrarian bet with sectors that have an uncertain demand outlook.

Market selection dynamics in the US differ from global markets, as there is more market diversity in the US than in many other countries, and the differences became starker amid the pandemic. Some markets, especially some of the largest or most tourism-driven economies, saw sharp employment declines and weakening apartment and office demand. Other markets benefited from continued in- migration and saw greater stability. Investors need to decide if the acceleration of pre-pandemic migration trends will continue or if markets that lost ground during the pandemic will rebound rapidly.

For real estate investors in the US, one thing they can count on is supportive capital markets. Low interest rates are upping the appeal of equity real estate compared to fixed income alternatives. Meanwhile, the strong performance of the stock market in the last year has positioned some investors to be under-allocated to real estate. Equity flows are being supported by aggressive lending, and with interest rates remaining low, borrowing is accretive for real estate investors. This is contributing to competitive bidding and aggressive pricing on core transactions of favored property types while limiting distressed transactions of challenged property types. The result is transaction volume is down, but healthy for favored property types while weak elsewhere.

Demand Outlook Dispersion Between Property Types

Overall, US real estate investors face tough decisions on property type and market selection. There is ample capital to access, but limited deal flow is putting a premium on the ability to access opportunities. Strategy calls are challenging in this environment and there is a premium on making informed decisions about where to focus. Partnering with broad, established platforms is one way cross-border investors can ensure their capital can nimbly respond to a changing investment landscape.